Top Wedding Budget Advice: Simple Tips to Keep Costs Down

Worried about wedding costs? This wedding budget advice will help you plan and stick to a budget. Learn how to set priorities, allocate funds, and avoid hidden expenses. These tips will ensure you enjoy your big day without financial stress.

Key Takeaways

-

Establish a clear wedding budget early and discuss contributions from both families to align expectations.

-

Prioritize key elements of your wedding to allocate spending effectively and reduce costs in less important areas.

-

Utilize budgeting tools and track expenses diligently to stay within budget and account for hidden costs.

Determine Your Total Budget

Begin by determining your total budget, considering all potential financial resources like personal savings and family contributions. Have an open conversation with your partner about your financial situation and any obligations that could affect your wedding fund.

Evaluate your savings and family contributions to get a clear picture of your overall budget. While modern couples often split costs with family, this can vary, so confirm financial expectations early. Ensure your budget aligns with what you can afford, setting realistic expectations.

Also, consider your monthly savings rate to meet your realistic wedding budget within your timeline. Review average wedding costs in your area and draft a list of expected expenses to prioritize spending effectively.

Identifying Key Contributors

Clarifying key financial contributors is essential for shaping your wedding budget. While modern couples often share costs with families, the traditional expectation of the bride’s family covering expenses is less common.

Discuss contributions with family members early to avoid misunderstandings. Clarify how their contributions will be used to ensure transparency and prevent conflicts.

Setting Priorities for Your Wedding

To manage costs, discuss with your partner the three most important aspects of your wedding. This helps align your expectations and ensures the wedding reflects what matters most to you.

A joint priority list can streamline decision-making in the planning process. For example, if photography is important, allocate more budget to it. Conversely, save money on less important elements like designer gowns or elaborate decorations by opting for simpler alternatives.

Setting a spending limit helps manage costs and prioritize key elements. Recognizing financial pressures can guide compromises, ensuring you stay within budget while creating a memorable experience.

Guest List Management

Managing your guest list is crucial for keeping costs down. Reducing the guest count can significantly lower expenses related to gifts, transportation, and catering.

Define your rules for inviting guests to ensure consistency. Assess relationships and consider inviting only those you plan to maintain contact with. Decide on inviting children and plus-ones.

Consider the venue’s capacity to avoid overwhelming numbers, which can significantly impact your budget.

Allocating Your Budget

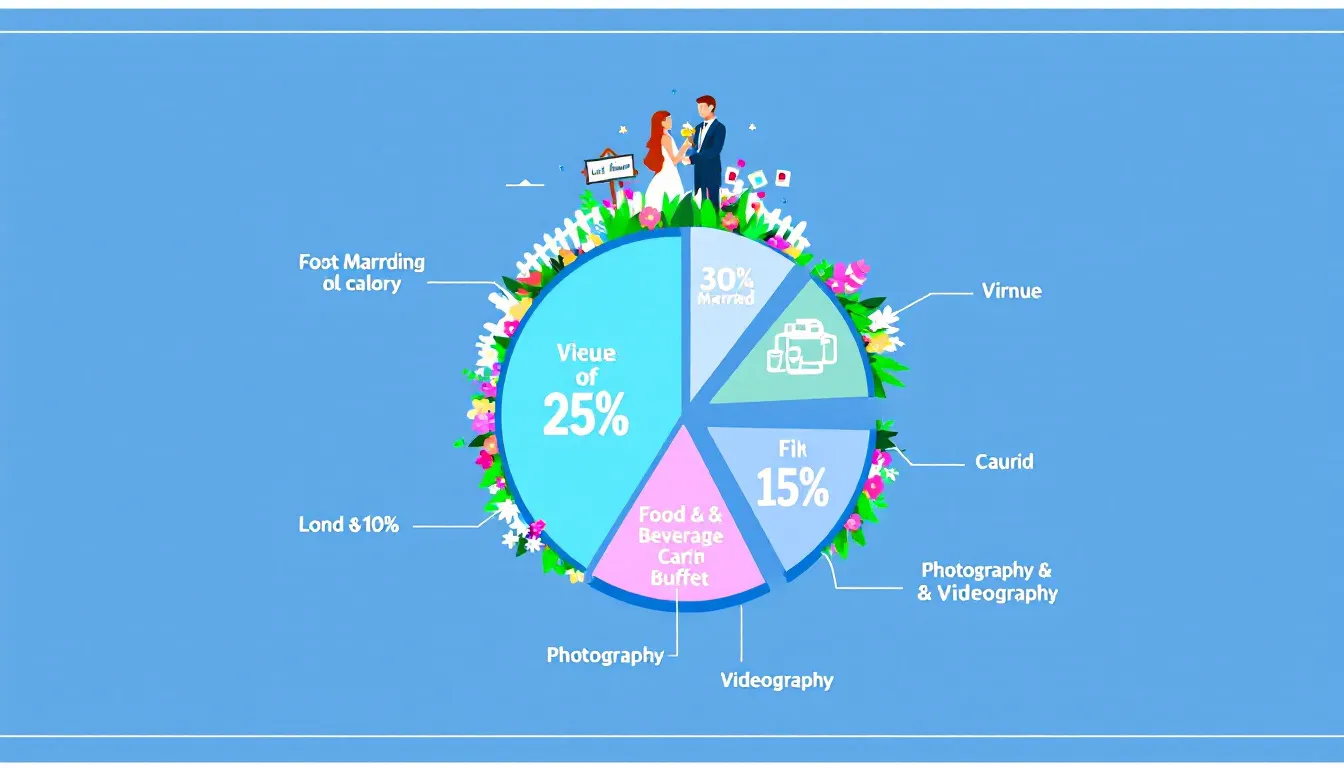

After determining your budget and key contributors, allocate your funds effectively. Typically, 45% should go to venue, catering, and rentals. Each guest can add $250 to $500 to overall costs.

Allocate about 10% for flowers and decorations, 2% for favors and gifts, and around 12% for a wedding photographer and videography to ensure quality documentation.

Allocate 9% for wedding attire and beauty services, 2% for transportation, and another 2% for cake and dessert expenses.

Categorizing your wedding budget helps manage spending. Regularly update and review to stay within your budget.

Hidden Wedding Costs to Watch Out For

Hidden wedding costs can add up quickly. Be aware and plan for expenses like beauty treatments, bachelorette parties, vendor meals, and overtime costs. Include cash allotments for vendor tips in your budget.

Gratuities can range from $15-$20 per person for musicians to 15-25% for hairstylists. Including a budget buffer for unforeseen expenses helps avoid financial pressure and ensures a smoother planning journey.

Choosing a Wedding Planner

A full service wedding planner can significantly reduce wedding planning stress. They often have wedding vendors relationships that lead to better service and cost savings. A full-service planner assists from start to finish, managing every detail to align with your vision.

Wedding planners typically cost around $2,100, with month-of planners ranging from $2,000 to $4,500. High-end planners start at $10,000. Allocate about 6% of your total budget for a planner.

Select a planner based on your specific needs and vision. Day-of coordinators manage vendor communications and resolve issues. Destination planners handle logistics for events in different locations.

DIY vs. Professional Services

Decide which wedding aspects to handle yourself and which to hire professionals for to manage your budget during your wedding planning journey. Cost-effective DIY options include décor, favors, and welcome bags. Complete these projects in advance to ensure readiness.

However, elements like flowers and food are best handled by professionals to ensure quality and reduce stress. Balance DIY projects with professional services to save money while maintaining quality.

Tracking Your Expenses

Tracking expenses is vital to keeping your budget organized. Use budgeting apps like Wedding Planner Countdown, Fudget, Pocketbook, Splitwise, Track My Spend, and Wedding Happy to monitor expenses effectively.

A detailed breakdown of expenses helps track spending and ensures all aspects of the wedding are covered, helping you stay within budget and avoid hidden costs.

Negotiating with Vendors

Negotiating with vendors can help you stay within budget. It’s acceptable to discuss specific service aspects, but respect final pricing. Flexibility in requests, like adjusting service hours or choosing less expensive options, can facilitate negotiations.

Politeness and appreciation when discussing pricing can create a positive negotiation environment. Understand vendor quotes before negotiating, as some costs are fixed. If pricing exceeds your budget, seek alternatives rather than negotiating lower prices.

Sample Budget Breakdown

A sample wedding budget breakdown can help allocate expenses effectively. Typically, couples allocate about 29% to catering and 37% to the venue within their wedding budgets.

Photography usually takes up about 8% of the budget, while live entertainment accounts for around 12%. Keep a contingency fund of about 5-10% for unforeseen expenses.

Adjust the budget based on your unique priorities and circumstances.

Managing Destination Wedding Costs

Destination weddings can be more affordable, averaging around $9,850. However, consider additional costs like airfare, accommodation, and travel expenses. Airfare averages $1,000 per couple, accommodation about $2,400, and venues/packages around $6,450.

When booking hotel room blocks, consider guest accommodation, discounted rates, and hotel incentives. Travel credit cards can offer bonuses after meeting spending thresholds, saving on travel expenses. Couples are not obligated to cover guests’ travel costs.

Planning for Pre-Wedding Events

Pre-wedding gatherings are optional but enhance the experience. The engagement party is often hosted by the bride’s parents, but anyone in the couple’s circle can organize it.

Immediate family and the wedding party are typically invited to the rehearsal dinner, often covered by the groom’s parents. It usually takes place the evening before the wedding day, providing a relaxed setting for families to connect.

Bachelorette parties and bridal showers also enhance pre-wedding celebrations, each with its own costs.

Utilizing Rewards Programs

Rewards programs can maximize savings on wedding-related expenses. Hotel rewards programs can offer discounts and bonuses. A travel credit card linked to hotel reservations can accumulate additional points.

Credit card rewards points can be redeemed for wedding gifts, especially through retailers like Amazon. Cash-back options can reduce spending on gifts. Sharing accommodation costs with friends can also yield rewards points if booked with a credit card.

Creating a Contingency Fund

A contingency fund, 5-15% of your total budget, is set aside for unforeseen expenses.

It prevents cutbacks on important elements and provides resources for post-wedding expenses.

Summary

In summary, setting a realistic wedding budget is crucial to ensuring that your big day is both memorable and affordable. From determining your total budget and identifying key contributors to managing hidden costs and utilizing rewards programs, every step is essential in creating a seamless wedding planning journey.

By following these tips and strategies, you can keep your wedding expenses in check while still creating the wedding of your dreams. Remember, the goal is to start your married life on solid financial footing, making wise decisions today for a brighter tomorrow.

Frequently Asked Questions

What is a reasonable budget for a wedding?

A reasonable budget for a wedding is around $33,000 to $35,000, depending on your location and preferences. By planning thoughtfully, you set the stage for a beautiful celebration within your means!

Is $30,000 a good wedding budget?

$30,000 can be a great wedding budget if you plan carefully and prioritize your expenses. Focus on the elements that matter most to you and get creative to make your dream day a reality!

Is $5000 a reasonable budget for a wedding?

Absolutely! With careful planning and some savvy tips, you can create a stunning wedding for $5,000. Let’s make your dream day both beautiful and budget-friendly!

How can I determine my total wedding budget?** **?

To determine your total wedding budget, evaluate your savings, any contributions from family, and your overall financial situation. By creating a realistic budget based on what you can afford, you’ll set yourself up for a stress-free planning experience!

How do I identify key contributors for my wedding budget?** **?

To identify key contributors for your wedding budget, have open discussions with family members about their willingness to help financially. Early communication is essential to set clear expectations and ensure everyone is on the same page!